Consolidated Insurance Group has a deep understanding of our clients’ needs. Each group faces different challenges and cost pressures in their marketplace. Consolidated Insurance Group is a full-service employee benefits firm. As such, we can provide all available options to our clients including custom self-funded plans, bundled self-funded plans, and fully-insured plans.

SELF-FUNDING

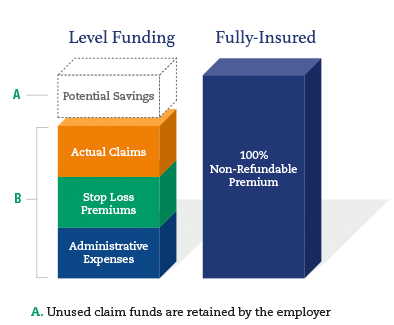

Level funding is a form of partial self-funding that enables the employer to budget for monthly expenses while enjoying the financial advantages that larger organizations have enjoyed for years. With level funding, the employer pays a set amount each month to cover fixed costs as well as anticipated claim costs. Stop loss insurance funds claims that exceed the employers funding limit. If claims are below the funding limit, the surplus remains in the employer’s claim fund.

Partially self-funded medical plans are established to gain better control over providing medical benefits to employees. By self-funding a plan, the employer takes financial responsibility for paying the medical claims of members. This allows the company to gain control over expenses and realize savings due to lower claims volume, lower taxes, and lower overhead costs.

A properly managed self-funded benefits plan can benefit your organization in many ways.

FULLY INSURED

With Fully Insured health plans, employers pays a fixed premium each year based on the zip code of the business, number of participating members, and age of the employees. There is no medical underwriting required for Fully Insured plans. Because of this, premiums tend to run higher than Self-Funded plans.